What is Crypto Stacking? 18 July, 2022 • 7 min read

You have probably heard a lot about Crypto Staking and Staking Rewards from your friends, coworkers, or influencers. The majority of them claim that the greatest method for passive cryptocurrency income is staking.

And now, you probably want to understand more on What is Crypto-currency staking? And how can I stake my crypto for passive income?

Let’s try to understand in most simple & relative terminologies.

You can consider that staking a cryptocurrency is equal to depositing money in a traditional savings account. Traditional banks will pay interest as it uses your funds for investments and high interest loans to other lenders.

Similarly Crypto staking platforms will act as bank, which will pay you good rate of interest on your crypto assets staked, while lending the same assets to other crypto entities for evaluation of transactions which are made on the blockchain or for higher interest loans.

Now you understand the basics, let’s ask one more important question How much interest rate we will be getting on crypto staking?

This varies will platform to platform. There are certain exchanges or crypto institutions which will pay you fair amount of interest rates like 3% to 15% some even offer 20% & more too. It all depends on crypto assets involved in for staking & the risk appetite of that staking platform as well as crypto users willing to take for higher yields.

Remember, the more the interest rate the probability of getting wrecked also increases.

In market, staking rates of 4% to 12% below is considered a bit fair trade of with risks associated with it. Which are quite multiple times than what interest rates you will be getting on bank deposits.

That’s why many show interest in buying the cryptocurrencies and put them for staking to earn a decent return during the bear market times.

Advantages of Crypto Staking

Staking is a good option for those who want to generate greater yields through long term investments especially the investors.

It is the simplest approach to get a passive income from your idle cryptocurrency assets.

Staking makes you a node that verifies transaction data, adding to the blockchain's security.

Most importantly, staking is much less harmful to the environment than mining.

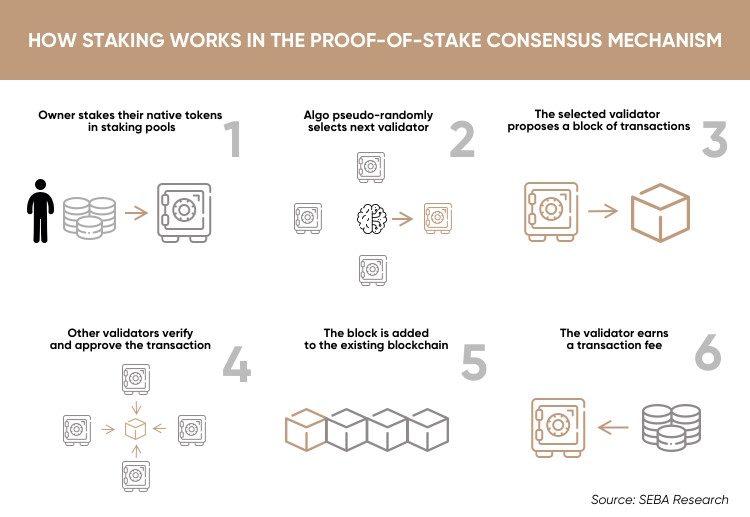

Ok great, now let’s understand How Cryptocurrency staking works in the background in detail?

Proof of stake is a consensus mechanism that works by selecting validators in proportion to their quantity of Crypto holdings in the associated cryptocurrency. This is done to avoid the computational cost of proof-of-work methods.

Not all cryptocurrencies are using Proof of stake mechanisms for block confirmations

Which Crypto Currencies I can stake?

Bitcoin – which is first & most dominant uses Proof of work consensus mechanism. So, we can’t stake Bitcoin for generating more blocks.

Ethereum – Next famous & dominant crypto currency also uses proof of work so far now, but it is in the process of Migrating its consensus models to proof of stake with the name of Eth 2.0. This migration in pipeline for long time and it should be round the corner.

Most of the other Crypto currencies which are using Proof of staking can also be staked and Tokens which are built under ERC 20, can also be staked.

These are just a few tokens to name which can be staked & earn passive income. Most of Whichever tokens you have they should be staked, as business are inclined to show financial rewards to their communities.

Now, where can I stake those coins?

Most of the centralized exchanges provide staking feature for different crypto currencies.

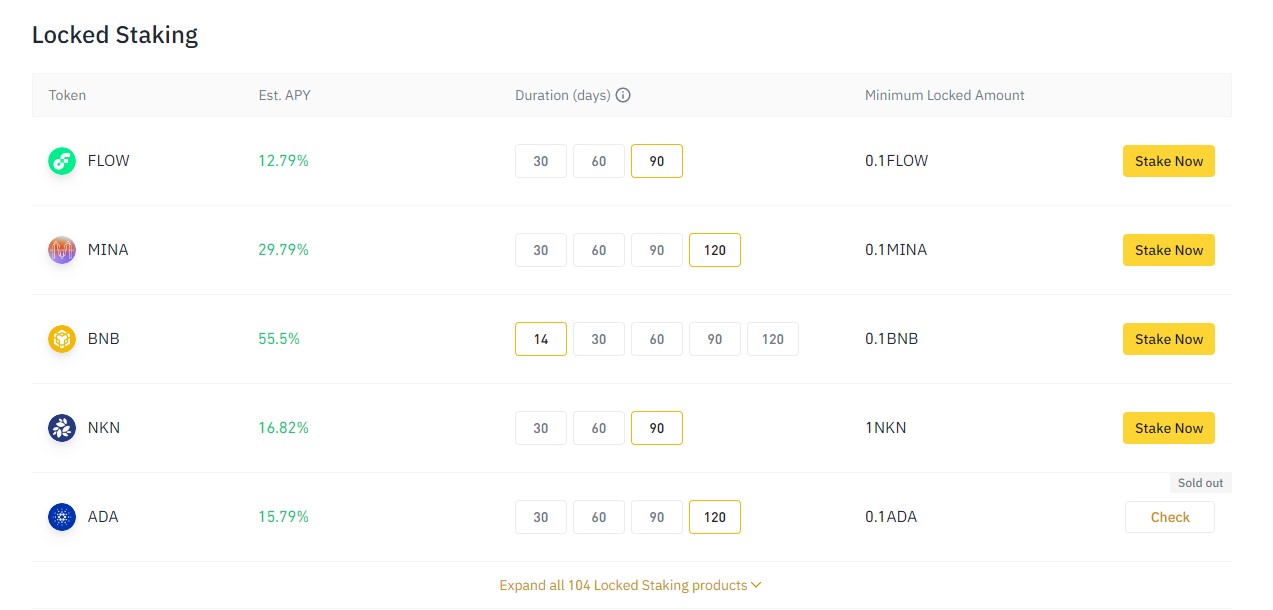

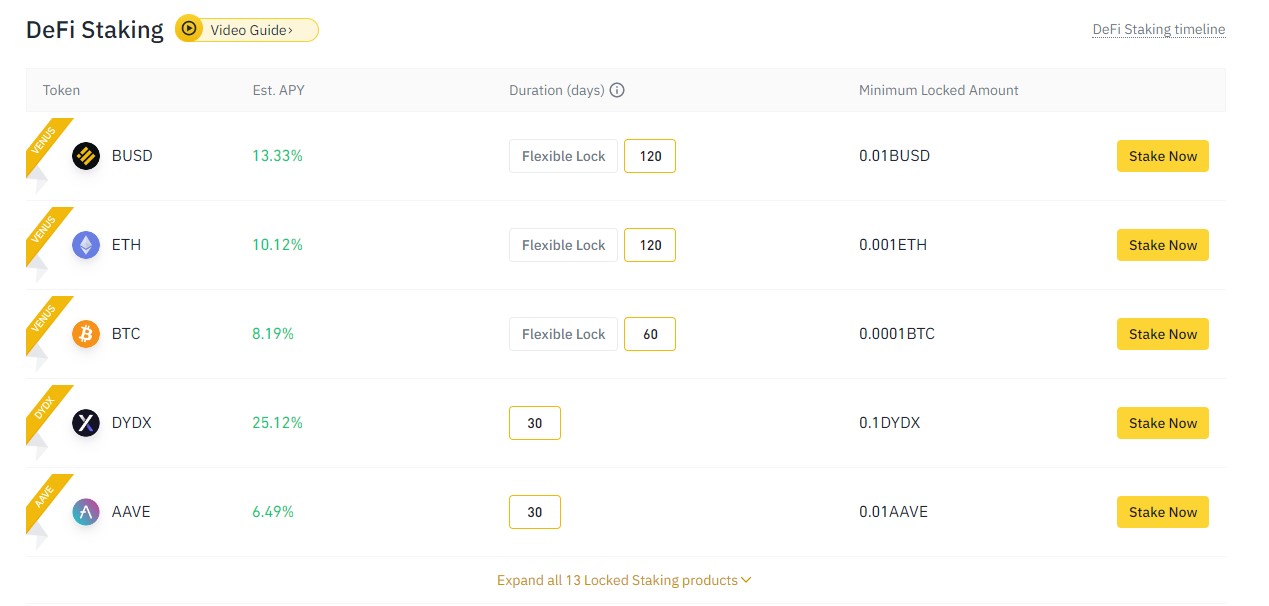

For example, Binance is one of the high-volume crypto exchange in world and it offers, varied interest rates for different currencies & different locking periods.

Like Binance, couple of other crypto exchanges which provides Staking features.

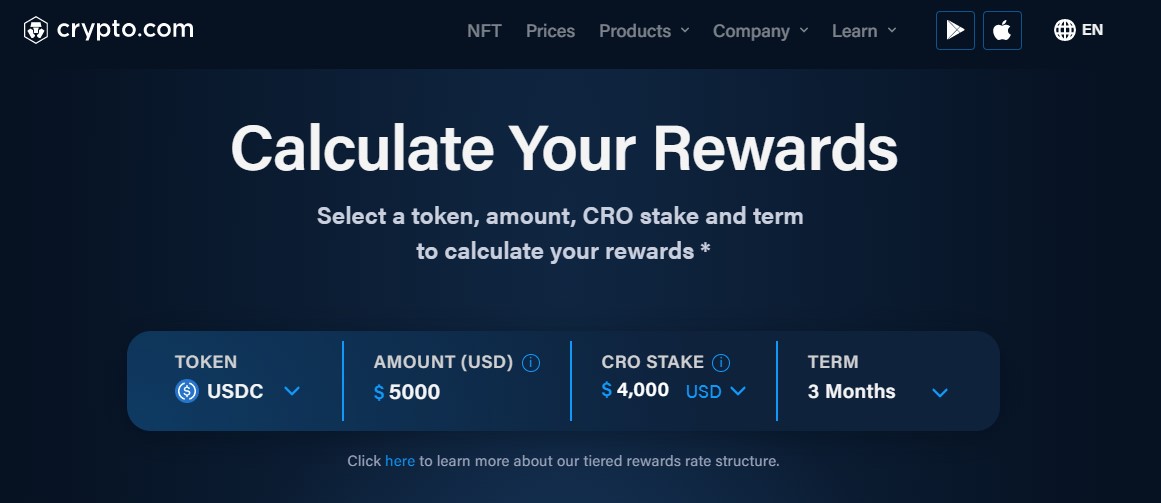

Crypto.Com

Crypto.com is one of the fastest growing crypto exchanges with 50 Million users across 90 countries. It supports 40+ crypto currencies under their staking programs with different yield rates. It also provides a calculator based on the proposed interest rates as how much you can earn beforehand.

eToro

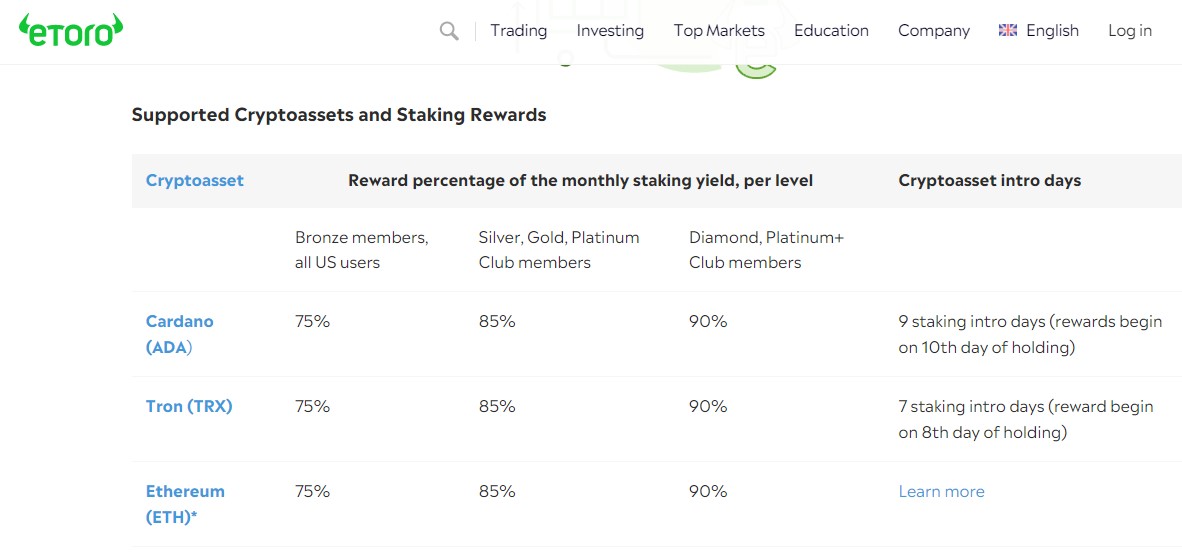

Etoro is another exchange platform which allows their users to earn rewards by staking their crypto tokens. They provide daily snapshots of each user’s holding and monthly rewards are distributed on the 14th day of following month.

eToro has staking features for very less number of crypto assets but they are working to add more.

There are many more platforms which provides the similar staking features.

Also, you have to be cautioned about the risks with staking cryptocurrencies.

Risks of Staking Crypto:

Staking may require you lock the crypto assets for certain period of time. During the staking period you can’t sell your assets.

Crypto prices are very much volatile. During the lock up period, price may go down sharply. If prices drop are steep then it will outweigh the value of the yield received through staking.

Even on some platforms, you can’t unstake immediately also. They will have unstaking period for a week or so. Keep an eye on such terms & conditions.

There is always risk of staking platforms going rekt [bankrupt]. Some of the high yield platform take high risk to provide more rewards to their users. If not managed well, this may wipe out the entire crypto investments you staked.

Conclusion:

Staking benefits both the users - those active in the cryptocurrency realm and those outside of it. Stakers can benefit from rewards on their crypto investments, potentially raise the value of their holdings, and support a vibrant cryptocurrency ecosystem.